Free online car insurance quotes

Have you ever imagined getting cheap car insurance quote for your lovely car? Well, first let’s discuss what is online car insurance quotes.

Before getting an insurance cover for your car it is best to do a routine check on all insurance companies and what they charge. It is also important to note what kind of cover you will get and at what price.

Most insurance companies have the same policies or similar policies but they charge according to various aspects of the car or the owner.

By now it goes without saying that if you have a previous record of dangerous driving or drunk driving the policy quotation will be higher due to the high risk of the driver causing an accident while intoxicated.

In simple term this is the amount of money you will pay whenever you want a car insurance policy and usually found online. This amount is determined based on the following;

- The type of a car you want to insure

- Your age

- Your driving records

- Your place of residence

In most cases, the insurance company will gauge the risks factors associated with the information provided above. For example, if you have poor driving records such as being taken to court for careless or reckless driving the insurance will charge you high because of this.

Also, if you leave in a place where there is more car theft history that exposes your car from being stolen, you may pay high to insurance.

Your age also matters when given insurance, if you are a young driver, probably the insurance will view you as an inexperienced driver and expose your car to more risks and damages. There, you will also be charged highly.

The type of car you drive also matters. Some cars are expensive to maintain and even finding their spare might cost more than you expect.

In this case, the insurance has more information about different cars and they know your car damage cost. For them to play safe, they will have to estimate the best insurance quote for you.

How to get free insurance quotes

Use Online tactics

You don’t have to go to an insurance company to find your insurance quotes. Thanks to technology for enabling this aspect very easy to access. According to research, many people buy these quotes online over their internet-enabled devices. Companies such as State Farm and Allstate provide free insurance quotes.

What to consider before purchasing the insurance quotes online;

1.Don’t rush.

Don’t rush when purchasing your online insurance using car insurance quotes because you might find yourself scummed. There are many insurance companies online with low or cheap insurance to lure clients to their basket. Please you do not want to be a victim of insurance scum.

2.Reviews

First, you have to check the insurance company reviews online. There are many websites you can use to check whether the insurance company is trustworthy. These websites include; Trustpilot, Sitejabber among others. If your chosen insurance company does not display more than 65% good reviews, you have to find another company. These reviews belong to other clients who fall into the insurance scam trap and they are trying to warn others.

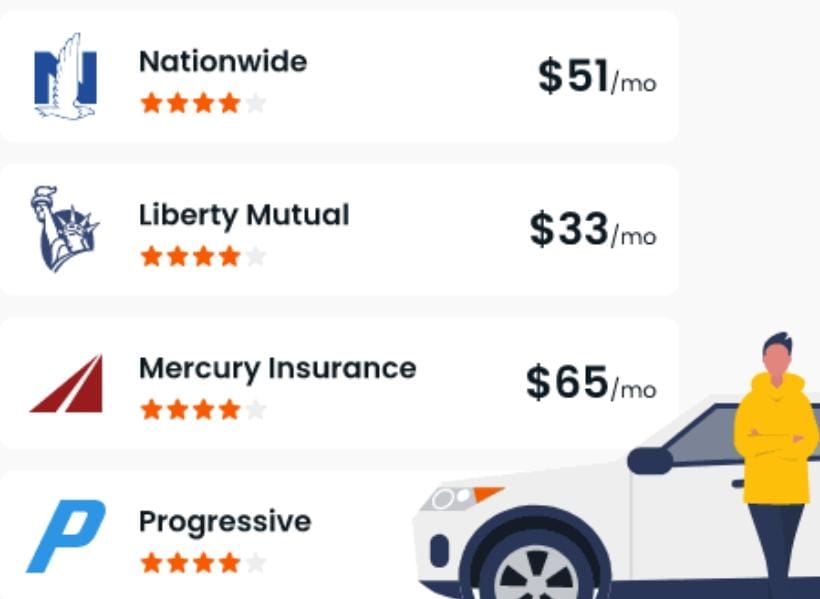

3.Insurance Quote price

Just because some companies have more good reviews, they take that as an advantage to hiking their insurance prices. You also avoid this by comparing the best prices for well-reviewed insurance companies. You might realise two different companies offer the same cover but at different prices. Find a price that suits your financial capabilities.

What your insurance covers

Don’t assume that the insurance company will cover all that you expect. Some companies have specific covers and this should be your first thing to ask. However, we have common covers such as third party and comprehensive. In most cases, third-party insurance covers the other party but not you.

This means that when you knock another car with third-party insurance means that they will pay the other car but you have to repair your car, on the other hand, comprehensive insurance covers the entire damage. This is the safest insurance cover one should have. But because of the high cost, most people consider taking third-party insurance.

Some insurance may have other covers that you might have to read and understand. Therefore, identify what exactly do you want the insurance company to insure and check whether your cover matches with theirs.

Best car insurance companies

1.Allstate insurance

This insurance company charges $1674 per year on its premium. Allstate provides a lot of support to young drivers with its wide variety of student discounts. Students are able to save once they combine their good grades with home insurance plus auto insurance.

It is found in all the 50 states including Washington D.C. and was founded in 1931. It offers roadside assistance but you will have to pay an additional cost for this service. It only offers policy payments at intervals of 6 months unlike other companies who offer 12 month policies. You can get a quotation on their website or by calling an agent or meeting up with him to iron out your concerns.

2.Erie insurance

Erie insurance company charges $1082 per year on their premium. This is the cheapest car insurance on the market as of May 2022 but still has some wonderful products. It has an inflation lock on its rate to protect customers from unpredictable inflation rates.

It is easily accessible and has a coverage of over 13 states including Washington D.C. It is based out of Pennsylvania and has been there since its establishment in 1925. I t also offers discounts on students with an increased discount when their whole family subscribes to Erie thereby reducing the lowest premium even further.

3.New Jersey Manufacturers

This car insurance company charges $1310 per year on its premium. It is not a big insurance company but it has long lasting experience in this industry as it was founded back in 1913. It covers only five states but boasts of great customer satisfaction.

It has a good rating about processing claims meaning its financial capacity is strong. It offers online quotation services and claims processing but you have to pay an additional cost for roadside assistance.

4.Auto-owners

This particular car insurance company charges its customers $1157 per year on its premiums. It offers discounts on drivers who have great records in road safety exhibiting little to no accidents. It was found in 1916 and it covers just 26 states in the U.S.

It has great ratings about customer satisfaction and processing claims meaning it is financially stable. The have great discounts for their customers such as the automobile plus package which includes identity theft protection and mobile phone protection cover.

5.USAA

This car insurance company charges $1471 per year to its customers. They cater to active or veteran military forces and members of their family. They have several products that help servicemen either buy or insure their vehicles. They offer discounts to student drivers, safe drivers and storage of cars on military bases while on deployment.

Advantages of free online car insurance quotes.

- online car insurance quotes is flexible and easy to access, compare and select based on your insurance needs.

- You have more time to make decisions.

- You do not need to have more insurance knowledge to get the quote since it is straightforward.

- You can make calls or emails to seek clarification in your comfort zone.

Disadvantages of free online car insurance quotes.

- Sometimes the insurance online quotes providers keep track by calling their prospective online visitors and this is annoying.

- If not, be extra careful you make get scammed.

- Online insurance quotes offer less information regarding there cover.