11 Best Anti-Fraud Software.

Anti-fraud software is designed in a special way that monitors, investigates, and blocks fraudulent activities on your website.

It’s frequently used to prevent fraudulent transactions made with stolen cards or identities. It can also be used by companies to confirm users at signup and login, as well as other touch points involved in all transactions.

If you have an e-commerce company such as digital marketing agency, online retail ,Payment generating website among other and you receive online payments, this page is for you.

Top features of fraud detection software.

Anti-fraud software should cover a lot of bases, starting from chargeback prevention to identifying verification. Some must-have features of this software include:

Risk rules.

This is the cornerstone of fraud detection. It allows you to filter user actions based on the data you find. A basic risk rule would be; if the IP location belongs to a VPN block the login attempt.

Risk scoring.

In fraud detection, some rules can be static and only give the simple option to allow or reject the user action.

But a more sophisticated and up-to-date system lets you juggle your options by giving risk scoring to customers depending on how risky the situation is.

For example, if the customer is not based in the same country as the payment card, you add 5 points to their risk score as you await further moves.

Real-time monitoring.

When it comes to preventing chargebacks or complying with anti-money laundering regulations, your detection software should be able to monitor payments on your site.

You must also be able to immediately block a suspicious action before it’s too late using ID verification and account protection services.

Machine Learning engine.

The best fraud protection needs to have an ML or Machine Learning algorithm that can suggest risk rules based on your historical business data.

If the system can allow you to understand the reasoning behind the risk rules, that can be an added advantage.

Meet the following criteria.

Most fraud detection software is delivered as part of a platform that includes access to a live event database. Onsite software has the reputation of getting out of date and this makes the business vulnerable.

It’s therefore important to look for a Software-as-a-Service platform that includes software management and is capable of applying all updates automatically without the account holder’s intervention.

Your expectations from fraud detection depend on your business circumstances and whether you have IT and risk assessment experts on your team.

However, you should look at and analyze fraud detection based on the following criteria:

- It should be a fast identity checker that doesn’t hold up payments.

- It should be a service that can integrate with other current payment processing systems.

- It should have a clear and easy-to-use dashboard.

- It should have facilities for manual risk assessment.

- It should enable logging of all transactions, including scoring, for successful fraud prevention.

- They should offer a free trial, a demo, or a money-back guarantee for a risk-free assessment.

- It should be a fully protective anti-fraud software that doesn’t financially drain the business.

Best fraud detection software.

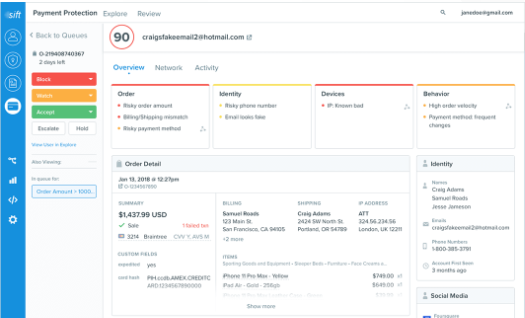

1.Seon.

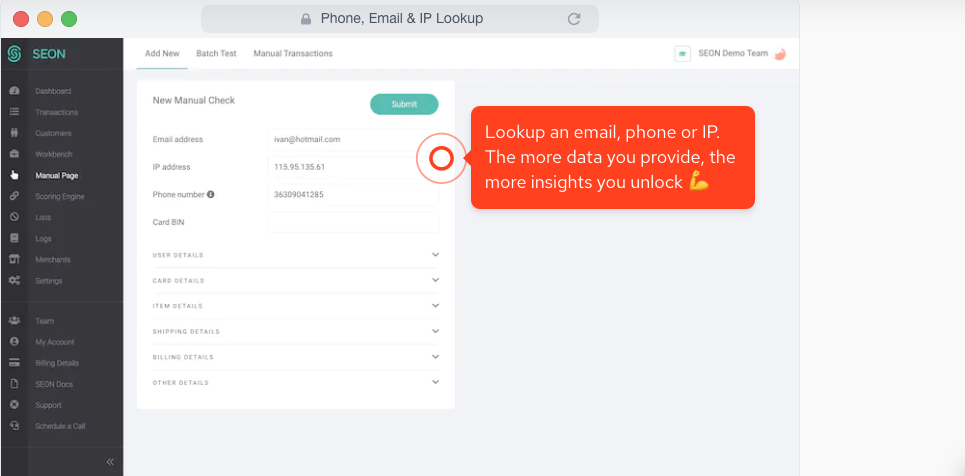

SEON prides itself on being accurate, granular, and industry reliable Anti-fraud software.

SEON features include in-depth device fingerprinting which helps you understand how users connect to your website, and complete data enrichment based on an email address, IP address, or phone number.

It also has a way to check 50 plus social media and online networks from related users that can reveal customers’ true intentions.

It has flexible integrations coz of API calls and is used by many businesses as an extra layer of protection for data enrichment only.

This is available via chrome login. With SEON, you can get complete control over the risk rules and even get suggestions from a powerful machine learning engine that suggests them based on your historical business data.

The downside of SEON is that it doesn’t offer checks because there’s no functionality to verify customers based on their official IDs.

Key features for Seon.

1.Fully modular solution.

This helps you pick and choose modules that make sense based on your fraud risk, from transaction fraud to iGaming multi-accounting.

2. Whitebox machine learning.

You can get rule suggestions in human-readable language that enables you to test and tweak them by yourself.

3.Reverse social media lookup.

You can gather data from 50 plus online signups including LinkedIn, Twitter, Telegram, and more which enables you to get an overview of your customers.

4.Outstanding CX-SEON puts the user front and center, whether it is thanks to a clean GUI or free ongoing support. This helps provide an ideal customer experience.

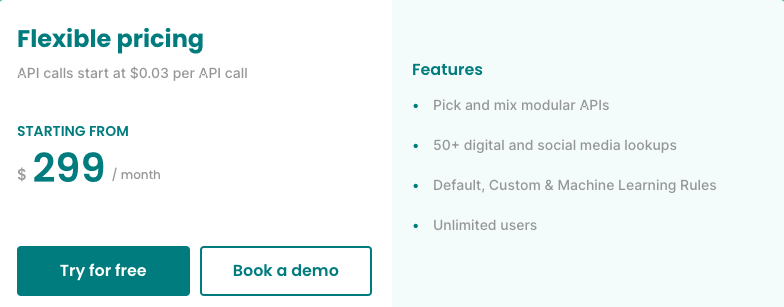

Pricing overview:

*Starts at $299 per month.

A free trial is available.

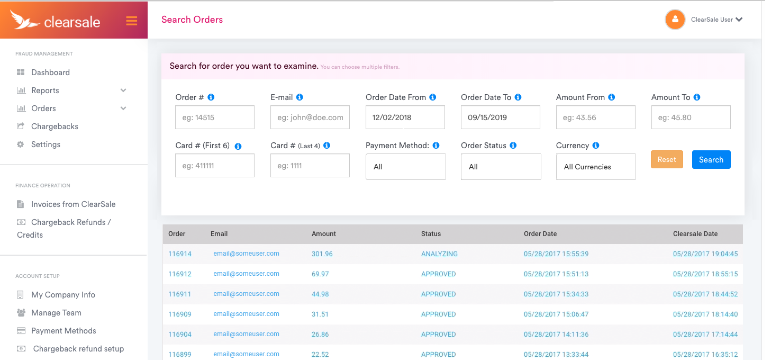

2.ClearSale.

ClearSale is an ideal Anti-fraud software for small eCommerce businesses as it sorts out fraud detection without much hassle and also integrates with popular online selling platforms like WooCommerce, BigCommerce, Shopify, PrestaShop, Magento, and Shift4Shops.

These integrations, plus the fact that the service costs nothing to set up, make it the best choice for small businesses.

The direct damage that a payment fraud will cost you is in chargebacks. But it’s important to note that excessive chargebacks can get you banned by the payment processor.

ClearSale puts in every effort to prevent fraud-related chargebacks because they have to pay you back in full for any chargebacks in one of its plans, and this makes them know that they can eliminate this problem.

ClearSale has also managed to attract large businesses that include Walmart, Staples, Channel, and Calvin Klein among its user community.

Key features for ClearSale.

- It can perform automated fraud detection as part of the payment processing task.

- It has features that enable it to integrate easily with major e-commerce platforms.

- CRM integration.

- Muilti-currency.

- Billing/Invoicing.

- Calendar management.

- 2-Factor Authentication.

- Forecasting.

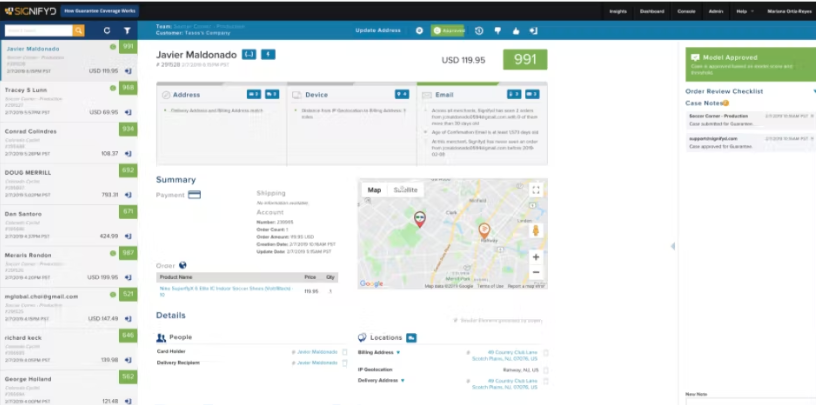

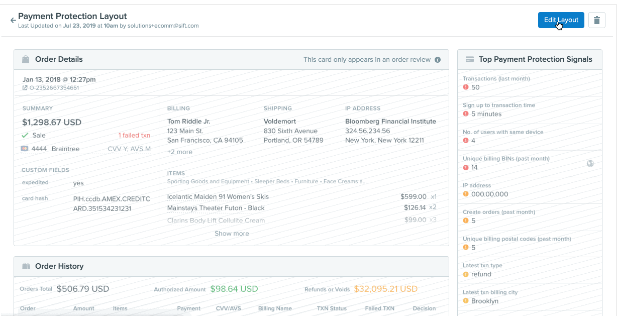

3.Signifyd.

Signifyd offers a range of Anti-fraud software solutions. It gathers fraud event data from its extensive list of online retailers and lists all the identities known to be used by fraudsters on the blacklist.

Though scanning through a vast list of IDs can drag the payment process, the created delay by Signifyd is barely noticeable because the service gives each potentially compromised identity the benefit of tabar doubt.

All genuine customers can complete their purchases quickly because AI processes are used for extra checks to authenticate the viability of the purchases.

The Signifyd platform, though it doesn’t integrate with e-commerce platforms, offers other services.

It has market analysis features that can help you identify your big sellers and work out how to boost sales of big-margin products, hence improving your profitability. Market information is also available for all Signifyd users worldwide.

Key features for Signifyd.

- It has tools that offer a combination of fraud protection and market analyses.

- It checks buyer identity against a blacklist.

- Has tools that gather market and fraud data from around the globe.

- Performs triage to focus deeper on likely fraudsters.

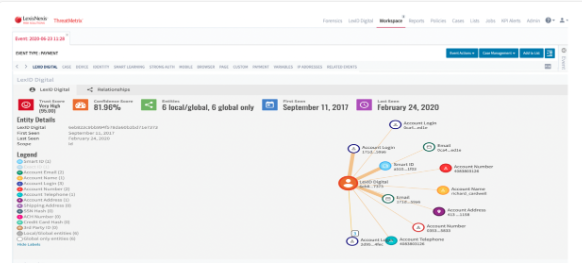

4.ThreatMetrix.

This Anti-fraud software is one of the several offered by LexisNexis as a risk management solution. This system runs through the buyer system on your site and comprehensively checks out the identity before it reaches the purchase stage.

The solution aims to process buyer information quickly to prevent genuine buyers from being inconvenienced.

The setup of this system encourages customers to open an account before deciding to purchase. This makes it possible for identity checks to be performed before the buyer gets to the stage of pressing the purchase button.

Aside from checking on the identity of the account holder, the ThreatMetrix system performs technological checks identifying whether the user is hiding the actual location. This is done with the use of proxies or VPNs.

The system also tracks the IP addresses of frequent offenders and runs a blacklist of such card numbers and home addresses.

Key features for ThreatMetrix.

- It covers technical identifiers, such as IP addresses and human identifiers.

- It can run a blacklist of known fraud-linked payment cards.

- It can stage identity checks to lighten the load at the moment of payment.

5.Fraud. net.

This Anti-fraud software is part of a cloud platform of services tailored toward specific industries namely eCommerce, travel, and financial services sectors.

The platform is organized as a menu of modules so you can choose which of the offered services you want to use. Facilities offered by Fraud. net include identity, address, email address, and phone verification.

IP address verification is also offered. Another module offered is visitor activity tracking which can identify possible fraudulent activities.

Login activity credibility, for example, arises when someone logs in from Mexico one minute and then logs in from England the next minute.

Identity verification works on a scoring basis. A combination of unusual activities is what raises the red flag.

Among the services of Fraud.net are chargeback protection, account takeover detection, and the use of stolen identity credentials. These checks can be applied to call centers, gift card schemes, in-person identity checks, and online systems.

Fraud.net has an extensive database of discovered fraudulent actors and their identities. On top of this, the company also offers Web Identity Disclosure checks for given identities and account credentials.

The downside of Fraud.net is that they don’t offer one single plugin for small businesses.

Key features for Fraud.net.

- Has a menu of many different fraud detection services.

- It offers technical checks as well as account takeover identification.

- It has a database of fraudulent or compromised identities at its disposal.

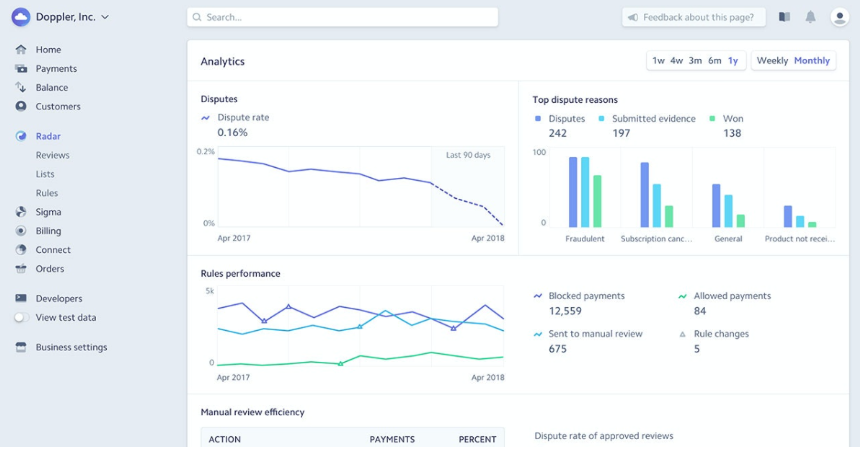

6.Stripe Radar.

Stripe Radar is an Anti-fraud software for automated online service that verifies customers just as payment transaction goes through.

Owing to its primary online business status, the importance of speed in its verification is always prioritized and so the checks are thorough but fast. It detects unusual behavior because it has the behavior of a particular buyer in its database.

Stripe’s global transaction analysis can also define standard indicators of fraudulent activities and intercept them before the fraud unfolds.

Stripe Radar also has additional intensification facilities from the user accounts that can run for your site. This helps tighten security with multi-factor authentication which makes the chances of a fraudster acquiring the account of a genuine holder minimal.

Chargeback protection from the Stripe Radar service draws data from major credit card companies to identify high-risk payment cards.

On top of that, the system also uses device fingerprinting and proxy detection which ensures that a single fraud trying to protect multiple activities can be bound to their true identity.

Key features for Stripe Radar.

- It holds a backlist of known fraudulent activities.

- It has tools that execute detection methods to tie multiple identities to the person they truly are.

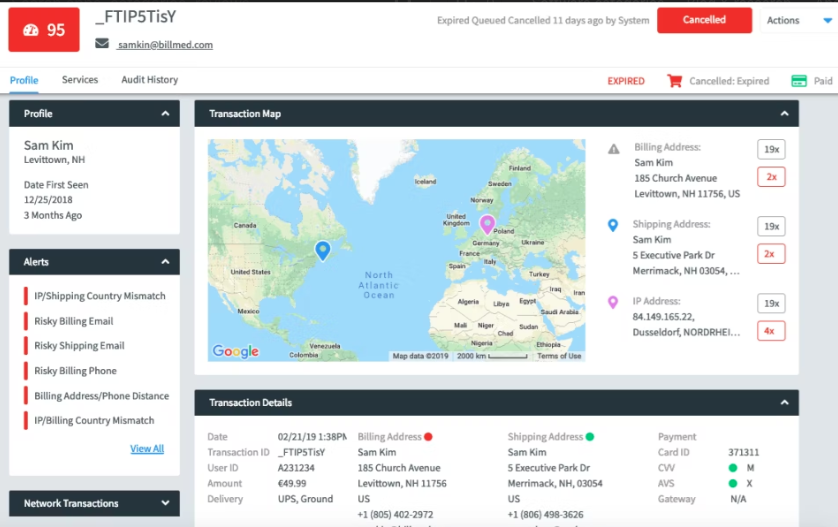

7.Sift.

This system operates the Digital Trust and Safety suite. They specialize in online services which include account takeover protection, payment fraud prevention, and content protection. Twitter and Airbnb are some of the big organizations using this system.

This Anti-fraud software consists of a machine learning module that helps to speed up and tailor the Sift fraud detection process by establishing normal behavior for all your customers.

Sift maintains a database of fraudulent activities and avails them to the user. These include the IP addresses, names, and other identity markers that can help identify a fraudster.

The database is also constantly distilled to provide updated fraudulent activity indicators. Sift is up to date with all the tricks of fraudsters that are trending and can therefore spot new fraud strategies as soon as they appear on the website.

Key features Sift.

- It has an extensive database of previous activities that provides a blacklist.

- It has a database of attack strategies.

- It has machine learning to identify behavior that is unusual for your buyer community.

8.Accertify.

This is an Anti-fraud software solution. It boasts of being a true end-to-end fraud solution provider from customer authentication to SCA optimization.

It also provides chargeback management for inevitable occurrences. Accertify’s main fraud detection mobile is called Accertify Digital Identity.

To develop insights, the machine learning algorithms turn to databases of community user behavior analytics and device intelligence which helps to decode how to label each user.

This is coupled with chargeback and reputational data from across the immense network of e-commerce partners.

Some of the prominent Accertify customers include SouthWest Airlines, StubHub, and Urban Outfitters.

This company is super confident in the scope of its databases that it does not look into alternatives or real-time data like digital footprints, which, to them, are less conclusive reports.

Key features for Accertify.

- Dynamic automation-Accertify’s automated scoring system can be adjusted to include more or less manual reviews depending on the level of risk to be involved.

- Huge databases-as an Amex subsidiary, Accertify draws data points like IP reputation data from a huge network of legacy e-commerce providers.

- End-to-end capability-the main offering here includes modules like chargeback management and an international entire payment gateway with additional compliance modules available.

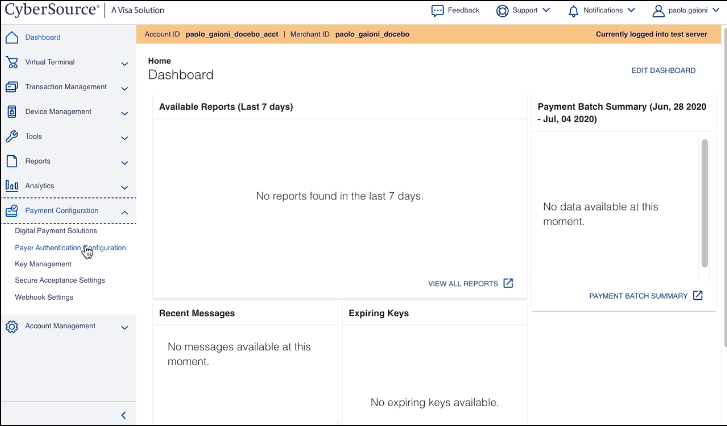

9.Cybersource.

This is Anti-fraud software was founded in 1995 and powered online payment as soon as e-commerce became a reality. In sheer processing and analytical data, Cybersource offers four main modules to address payment fraud.

All the modules are Visa’s Decision Manager Software. These modules which are payment acceptance, fraud management, payment security, and unified commerce payment solutions all come together to provide automated end-to-end service for e-commerce payments.

The unified payment solution allows businesses to easily transition between payment models, like BNPL, as well as take a new form of payment currency with confident fraud protection.

Other granular models in the suite cab assist merchants to grow their reach with the capabilities for currency conversion, and global tax compliance and also keep customer lifeline management

The downside of this platform is that because it leverages Visa’s truly massive yet historic database, there is always a chance some of the data could be stale.

It also focuses on businesses moving toward international diversification and omnichannel channels which leaves small businesses at a disadvantage because they can’t measure up to the standards.

Cybersource customers include Zoom, Rimowa, and Colgate-Palmolive.

Key features for Cybersource.

- Growth-specific software modules-it has modules specifically for both diversifying payment models and streamlining them, with super low friction 3DS-backed click-to-pay deployable.

- Dynamic data analysis- the fraud detection module constantly updates its ML statistical models and also dynamically applies the best model for each transaction, which smoothes automation.

- Currency conversion module-this gives it the ability to collect international payments with the confidence that you are staying compliant with local mandates with the global tax collector.

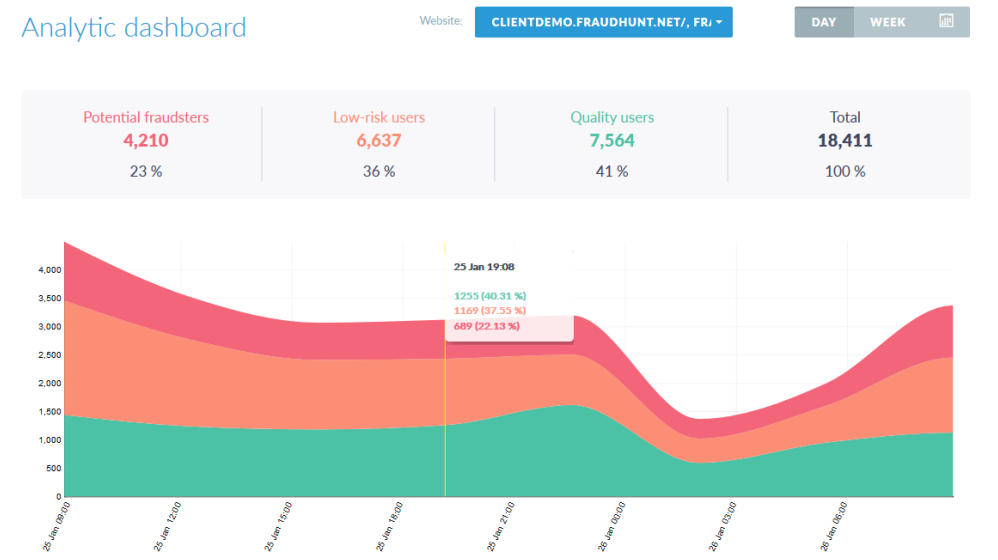

10.FraudHunt.

This Anti-fraud software was founded to provide emerging markets with affordable fraud prevention options.

So the data analysts and developers took proven methods and developed a platform that provides a dynamic security solution for e-commerce marketplaces of all sizes.

These include Crediexpress and Databrain. FraudHunttisk prevention mostly revolves around scoring incoming traffic based on risk points on their device and browser fingerprint.

Each user is therefore assigned a score based on whether or not they flip certain triggers that vary from proxy detection, identifying data from operating systems, browser information, and behavioral patterns inside the marketplace.

The software develops a real-time score based on the lookups performed during the customer journey and then assigns each a score. This enables it to categorize the customer into low-risk or potentially fraudulent customers

The downside is that, in FraudHunt’s effort to be an affordable fraud solution for emerging markets, the product offers less automation than an enterprise-level would require.

Key features for FraudHunt.

- Fingerprint ID module-FraudHunt’s flagship product leans heavily into bot detection to prevent ATO, credential stacking, affiliate scams, and content fraud.

- Accessibility-the main software offers google analytics integration capabilities and an intuitive reporting tool.

Pricing overview:

Bronze package-$25 per month, but the pricing can go up to $2500 per month for up to 10 million unique users.

11.Ekata.

This solution is part of the Mastercard Group and is a mature and established Anti-fraud software.

It was founded in 1997 originally under the name Whitepages.

Ekata offers global verification and fraud prevention via APIs.

These APIs come in the form of Transaction Risk API, Address Risk API, and Phone Intelligence API.

The anti-fraud vendor also offers two onboarding APSs namely Merchant and Account. On top of this is a pro insight tool that’s designed specifically for manual reviews.

Ekata has first-class experience with big companies like Lyft, Equifax, and Microsoft.

But as is normally the case with legacy anti-fraud software, they rely on their humongous databases built over the years which might not be reliable.

Key features for Ekata.

- Dedicated manual review tool-Ekata offers a complete solution for reviewing transactions and KYC checks manually. These include machine learning algorithms (The Ekata Identity Engine).

- Graph visualization-this feature is available but sold as a separate Ekata Identity Graph product.

SUMMARY

Businesses that sell online are apparent targets for fraudsters. But even the physical outlets rely on credit card processing almost as much as their online counterparts.

The most significant commercial fraud occurs in the payment phase. Too many refunds issued by payment card providers can result in the business incurring fees, delayed payment, or being banned from accepting cards for payment.

As the card payment processes occur through computers, it is important that these businesses also apply Anti-fraud software to prevent the fraudsters from realizing their targets, that is, before the transaction goes through.